Blockchain: financial system evolution or destruction?

19/01/2018

Evolution is a natural process, aimed at maintaining the ability to survive for biological, economic, organizational and other systems in a constantly changing environment and external or internal threats resistance. For the modern international financial system based on a centralized banking control, financial systems of a new decentralized type, based on blockchain technology brought the threat of a stability disorder.

Blockchain technology features

The technology of the blockchain is a distributed data registry based on the technologies of peer-to-peer (P2P) networks. The blockchain has no central servers and processing centers that help to prevent the vulnerability to attacks aimed at the central servers availability loss, and the integrity and confidentiality of the data stored on them. Below are the diagrams of data exchange in centralized and decentralized network architectures.

Centralized network |

|

In classical centralized data storage system the server and user have the encryption keys that allow them to establish a secure connection between themselves and perform a trusted data exchange. But what do we have to do if the data is exchanged with an unlimited number of network nodes and their credibility is not confirmed? This basic issue was solved in 2009 by the programmer under the pseudonym Satoshi Nakamotо, thus introducing the cryptography technology.

The data stored in the centralized systems is as secure as secure is the central server. Unauthorized access to the server gives one the ability to remove, replace or add data. The main feature of the blockchain technology is the irreversibility of the data entered in the registry. Since all data is stored simultaneously in the registers of all network members, unauthorized deletion, substitution and addition of data is possible only in case of gaining an access to electronic gadgets of a vast majority of network members at the same time. Due to the fact that the modern blockchain networks include millions of participants, the possibility of such an attack is extremely small.

The network members may make changes to the registry using their encryption key and have a complete access to this data anytime and anywhere in the world.

Albert Einstein explains the essence of the blockchain technology

Despite the great popularity of this technology during recent years and an avalanche increase of the cost and volume of capitalization of the first cryptocurrency Bitcoin that had been run on its basis, Satoshi Nakamoto has not revealed his true personality.

A new paradigm of information security

The relevance of international information and financial security issues is growing every year. With the technology development, the widespread use of computer and automated devices, the increase in processing power the number and scale of cyber threats are growing too. According to the analytical Agency Cybersecurity Ventures data , annual financial loss from cybercrime will reach $6 trillion in 2021. In a counterbalance to the growing threats the efforts aimed at ensuring a sufficient level of security are increasing too.

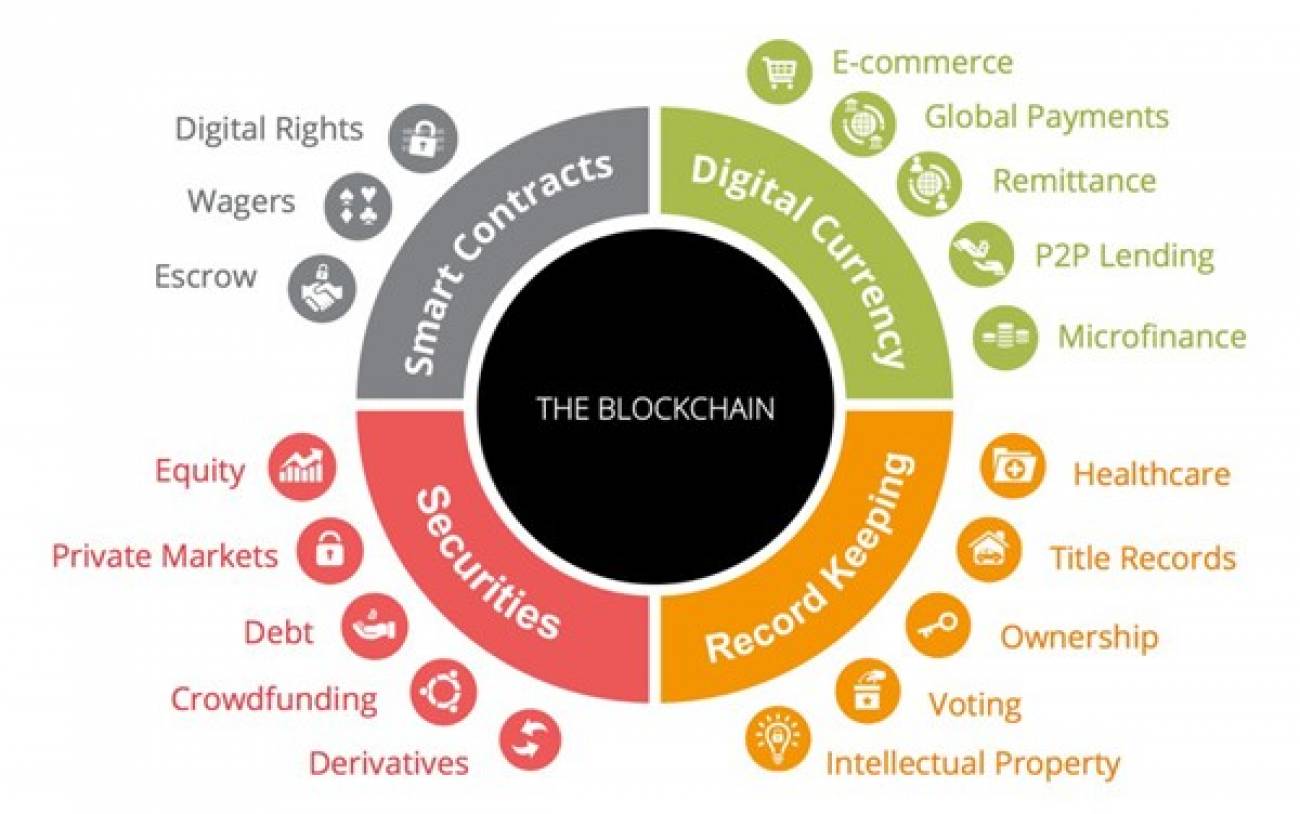

Blockchain opens wide opportunities for an organization of data storage and exchange in different spheres of life, such as the organization of voting, the registry of insured persons, medical examinations, banking deposits, verification of copyright and other rights, etc. Below is a diagram of some possible application fields of the blockchain technology.

Some possible application fields of the blockchain technology

The blockchain technology has already entered the service of the international community of information and economic security specialists. More and more ambitious projects aimed at solving problems in different spheres appear on its base. Below are some of them.

Ripple project offers a platform that allows to perform billions of transactions on the interbank market and significantly reduce transactional costs and shorten the time of money transfers passing all around the world. National Bank of Abu Dhabi (NBAD) plans to integrate the Ripple technology into its systems. NBAD will become the first bank in the middle East and North Africa that uses the blockchain technology to provide international payments service to its clients in real-time.

Tierion project solves the problem of digital data verification. The Microsoft Corporation has signed an agreement with the project for the purpose of a decentralized identification system establishment that will ensure the creation, management and validation of data with the help of an immutable registry of business processes.

Ethereum – the project implements the concept of using smart contracts containing the conditions of performing certain actions, such as goods shipment to the warehouse and their transfer to the customer. Using Ethereum, the developer can program the necessary triggers using the built-in scripting language. Each entry can be verified by all parties concerned.

Dynamis project provides a theology of a collective insurance with the help of smart contracts, based on the Ethereum project. The main task that the project solves is the unemployment insurance based on the assessment of insurance risks through the analysis of a new LinkedIn network participant`s social capital.

Aragon – the project implements the concept of decentralized organizations that exist only within the blockchain. The main objectives of the project are the company's owners` shares management, the organization of the decision-making procedure and voting, the functional of fundraising for business development and the distribution of posts.

Cryptocurrency as a development engine for the blockchain

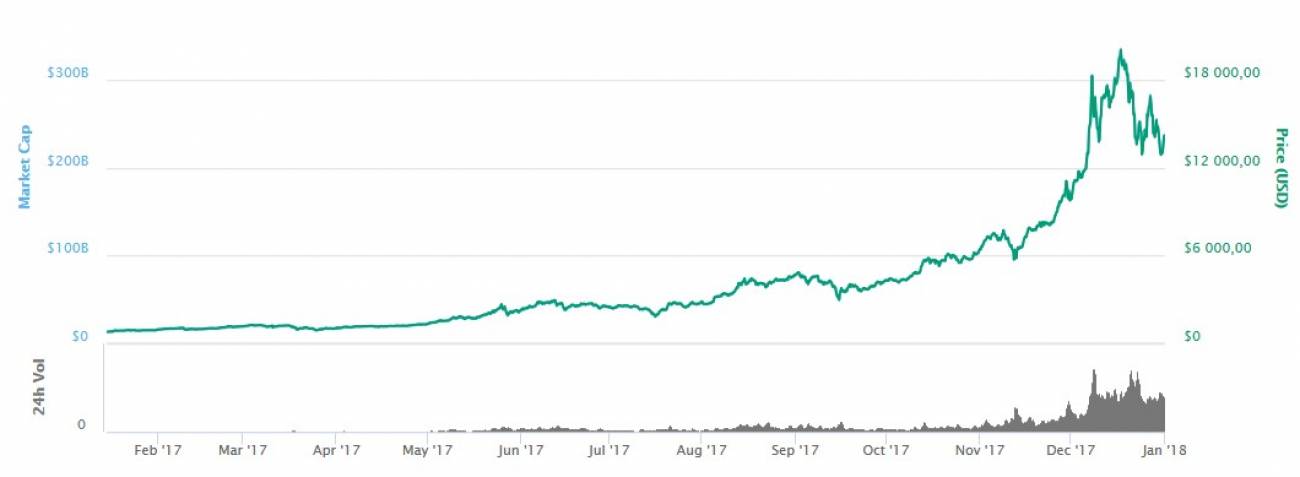

The project of Bitcoin cryptocurrency established in 2009 by Satoshi Nakamoto was the first example of a successful application of the blockchain technology. According to Coinmarketcup, at the beginning of 2018 the capitalization of Bitcoin exceeds 230 billion dollars. Below is a growth chart of Bitcoin capitalization volume for 2017.

The chart of Bitcoin capitalization volume

Undoubtedly, the investment opportunities that the international community saw in a radically new and unusual electronic means of payment have generated an avalanche interest growth from developers, safety specialists and experts in different fields, requiring the introduction of new technologies and approaches. This gave rise to the emergence of a huge number of new cryptocurrencies. According to Coinmarketcup, at the beginning of 2018 the total number of cryptocurrencies came near to the value of 1,500 units with a total capitalization volume of more than 700 billion dollars. Along with that the number of cryptocurrency with a capitalization of more than $ 1 million exceeds 700 units.

To estimate the volume you can be given an example of the capitalization volume of the major international companies according to Forbes, such as Apple with the capitalization of 586 billion dollars, JP Morgan chase with the capitalization of 234 billion, ExxonMobil with the capitalization of $ 363 billion.

Cryptocurrency and the juxtaposition of personal and public safety

From an etymological standpoint, the term "security" can be equated with the phrase "without insecurity". The system can be called secure if it is able to resist threats and does not create precedents for the emergence of new ones associated with its use. With all the advantages of cryptocurrency that provide a personal finance security, such as the cryptographic protection, a high degree of anonymity, a low transaction cost, there are significant disadvantages that endanger the global financial system, states and the society in general:

anonymity and unavailability of the identification of a sender and receiver of the payments in the cryptocurrency significantly complicates the identification and control of transactions, supporting illegal activity and the financing of terrorism;

the unavailability of registry of people possessing one or another cryptocurrency makes it impossible to assess the real property of the citizen in case of a debt recovery by court bailiffs, the property division upon divorce, etc.;

the mutual settlements in the cryptocurrency complicate the state control over the financial activity of organizations and citizens and enable them to evade paying taxes;

a significant withdrawal of citizens` capitals in cryptocurrencies carries the risk of instability of the economies, reduction of capitalization of banks and, consequently, of the bank financing volume of the real sector of the economy.

States have no control over the decentralized cryptocurrency, and that creates a danger to the society and the world in general. The technology of cryptocurrencies based on the blockchain technology is aimed at protecting the interests of the individual, but neglects the interests of the society and the state. This is of no surprise since the main background of the cryptocurrencies emergence is the human desire for financial freedom and independence.

The world`s countries` governments attitude to cryptocurrencies

The attitude of the various countries` governments is very contradictory: from the attempts of a complete ban and outlaw of the cryptocurrencies to the official recognition of already existing ones as a national currency or development of national cryptocurrencies of states.

The people's Bank of China announced the recognition of operation of the initial placement of cryptocurrency tokens ("ICO", Initial Coin Offering) illegal and on carrying out actions for the identification and closing of trading platforms that operate cryptocurrency.

According to CNBC Venezuela may become the first country officially switched to the cryptocurrency. According to CNBC reports, this turn of events is probably due to a severe shortage of dollar supply in the country and hyperinflation of the local currency.

South Korean government imposed restrictive rules on the ban on opening anonymous accounts in cryptocurrency, has banned the cryptocurrency tokens primary placement, has passed laws that give the authorities rights to close the digital currency exchange.

The Ministry of Finance of Israel in the fight against the shadow economy and the need to reduce the amount of cash in the country`s economy is discussing the possibility of creating a national cryptocurrency — cryptoshekel.

The blockchain technology has given impetus to the emergence of a data management projects that are fundamentally new in their ideology. Cryptocurrencies based on blockchain technology, though they create a risk to the international financial security because of the constantly growing interest and total capitalization, however, will not be able to replace the traditional centralized financial system in the near future.

Thus, a hybrid system that combines the security and financial freedom for each person, the security and economic stability to the global financial system can become a logical solution of this confrontation.